TaxBit Review: Enterprise-Grade Crypto Tax Solutions for Modern Traders – TaxBit Review Enterprise-Grade Crypto Tax Solutions for Modern Traders unveils the crucial role that innovative tax software plays in the fast-paced world of cryptocurrency trading. With the increasing complexities of crypto transactions, traders require reliable solutions to navigate tax compliance seamlessly. TaxBit has emerged as a key player in this landscape, offering a comprehensive suite of tools designed to simplify the tax reporting process while ensuring that users remain compliant with evolving regulations.

The platform’s user-friendly interface and robust features make it an essential resource for modern traders seeking to streamline their tax-related tasks. As we delve into the specifics of TaxBit, we will explore its history, standout features, and the unique benefits it offers to those operating in the digital currency space.

Overview of TaxBit: TaxBit Review: Enterprise-Grade Crypto Tax Solutions For Modern Traders

TaxBit is a leading crypto tax solution that caters to the needs of modern traders by facilitating the seamless calculation, reporting, and management of cryptocurrency taxes. The platform simplifies the complex landscape of cryptocurrency tax obligations, offering automated solutions that help users remain compliant while focusing on trading. The significance of crypto tax solutions like TaxBit cannot be overstated, as the ever-evolving regulatory environment requires traders to stay informed and compliant to avoid potential penalties.

Founded in 2017, TaxBit has rapidly evolved within the crypto tax landscape. Initially aimed at individual traders, the company has broadened its scope to serve enterprises and institutional clients, addressing the growing demand for comprehensive and scalable tax solutions in the cryptocurrency space.

Features of TaxBit

TaxBit boasts a plethora of features that establish it as an enterprise-grade solution. Key functionalities include:

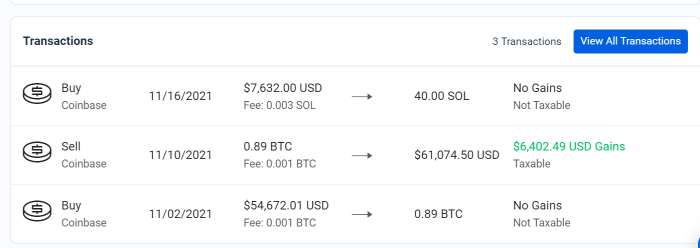

- Automated Tax Calculations: TaxBit automates the tax calculation process, reducing the time and effort required for traders to prepare their tax returns.

- Comprehensive Reporting: The platform provides detailed reports that Artikel trades, gains, and losses, ensuring traders can easily understand their tax obligations.

- Support for Multiple Assets: TaxBit supports a wide range of cryptocurrencies, enabling users to manage diverse portfolios without limitation.

- Audit Support: The platform offers audit trail features, ensuring that all transactions are accurately recorded and easily accessible if needed for compliance checks.

The user interface of TaxBit is designed for both novice and experienced traders, featuring an intuitive dashboard that simplifies navigation and enhances the user experience. Compared to other crypto tax solutions on the market, TaxBit stands out for its robust integration capabilities and user-friendly design, making it a preferred choice for many traders.

Benefits for Modern Traders

TaxBit addresses the unique tax challenges faced by crypto traders by streamlining the reporting process and ensuring compliance with tax regulations. Key advantages of using TaxBit include:

- Time Efficiency: By automating calculations and reporting, TaxBit allows traders to save time that can be better spent on trading activities.

- Enhanced Accuracy: The platform minimizes human error in tax calculations, ensuring a higher degree of accuracy in reporting.

- Compliance Assurance: TaxBit keeps users updated on regulatory changes, ensuring that they remain compliant with tax laws.

Testimonials from traders who have used TaxBit indicate high satisfaction levels, particularly regarding the ease of use and the effectiveness of the platform in simplifying tax reporting.

Pricing Structure

TaxBit offers a structured pricing model to cater to different user needs. The pricing tiers are Artikeld in the table below:

| Pricing Tier | Features Included | Target Audience |

|---|---|---|

| Individual | Basic tax reporting, automated calculations, email support | Casual or individual traders |

| Business | All Individual features, advanced reporting, priority support | Small to medium-sized enterprises |

| Enterprise | All Business features, dedicated account manager, custom integrations | Large enterprises and institutions |

TaxBit is considered cost-effective compared to its competitors, especially when the value of time saved and compliance assurance is taken into account.

Integration Capabilities

TaxBit seamlessly integrates with a variety of exchanges and wallets, simplifying the data import process for users. Supported exchanges include Coinbase, Binance, and Kraken, among others. Setting up integrations is straightforward:

- Create an Account: Users must start by creating an account on the TaxBit platform.

- Select Integrations: Navigate to the integrations section and choose the desired exchanges or wallets.

- Authorize Connection: Follow the prompts to authorize TaxBit to access transaction data from selected exchanges.

These integrations play a crucial role in streamlining tax reporting processes, allowing users to automatically import transaction data that is then used for tax calculations and reporting.

Security and Privacy

TaxBit prioritizes security by implementing robust measures to protect user data. These include encryption protocols, two-factor authentication, and regular security audits. Compliance with data privacy regulations, such as GDPR, ensures that user information is handled responsibly and securely.

Potential risks, such as data breaches or unauthorized access, are mitigated through continuous monitoring and updates to security practices, providing users with confidence in the safety of their sensitive information.

Customer Support and Resources

TaxBit offers a variety of customer support options, including email support, live chat, and an extensive knowledge base. Users can access resources such as tutorials, webinars, and instructional articles that provide guidance on using the platform effectively.

The availability of comprehensive customer support is essential for users, as it enhances their experience and ensures they can navigate any challenges that arise while managing their crypto taxes.

Future Developments, TaxBit Review: Enterprise-Grade Crypto Tax Solutions for Modern Traders

TaxBit is committed to innovation, with several announced and anticipated features aimed at enhancing user experience. Emerging trends in crypto tax solutions indicate a growing need for more sophisticated tools, and TaxBit is poised to lead in this area. The platform plans to adapt to regulatory changes by continually updating its offerings to ensure compliance and efficiency for its users in the evolving crypto landscape.