Uphold Card Review: Spending Crypto, Metals, and Forex with One Card sets the stage for this enthralling narrative, offering readers a glimpse into a world where diverse asset classes meet seamless spending. The Uphold Card stands out as a versatile financial tool that allows users to transact effortlessly across cryptocurrencies, precious metals, and forex. With its innovative features and user-friendly interface, it caters to a wide audience, from crypto enthusiasts to everyday consumers looking to diversify their spending options.

Discover how the Uphold Card’s unique integration of various asset classes creates an all-in-one solution for modern spending, ensuring you can make the most of your investments while enjoying the convenience of a single card.

Overview of the Uphold Card: Uphold Card Review: Spending Crypto, Metals, And Forex With One Card

The Uphold Card is a pioneering financial product that enables users to spend various asset classes including cryptocurrencies, precious metals, and foreign currencies seamlessly. With a focus on convenience and versatility, this card is tailored for individuals who want to simplify their spending habits across different asset categories.

The Uphold Card integrates multiple asset classes into one streamlined platform, allowing users to make purchases with ease. It supports a variety of digital currencies as well as traditional assets, making it an attractive option for crypto enthusiasts and investors alike. The target audience includes tech-savvy consumers who are comfortable with digital assets and seek a modern approach to spending their wealth. The unique selling points of the Uphold Card lie in its multifunctionality and the ability to transact across diverse asset types without the need for multiple cards.

How to Obtain an Uphold Card

Applying for an Uphold Card is a straightforward process designed to be user-friendly. The following steps Artikel how potential cardholders can acquire this financial tool:

- Visit the Uphold website or download the Uphold app.

- Create an account by providing necessary personal information.

- Verify your identity by submitting required identification documents.

- Complete the card application within your Uphold account.

- Wait for approval and follow any additional instructions to activate your card.

To be eligible for the Uphold Card, applicants must meet certain criteria which include being of legal age in their jurisdiction and successfully completing the identity verification process. The verification typically involves providing a government-issued ID and proof of address.

Spending Mechanism of the Uphold Card

Using the Uphold Card for transactions is designed to be efficient and user-friendly. Cardholders can easily spend their cryptocurrencies for everyday purchases, as the card automatically converts crypto assets to local currency at the point of sale.

Additionally, the Uphold Card allows users to convert metals and forex into spendable currencies, giving flexibility in how assets are utilized. The following currencies and asset types are accepted for spending:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Gold and Silver

- US Dollars (USD)

- Euros (EUR)

- British Pounds (GBP)

This diverse range of accepted currencies not only enhances usability but also adds significant value to those who wish to leverage both digital and traditional assets.

Security Features of the Uphold Card, Uphold Card Review: Spending Crypto, Metals, and Forex with One Card

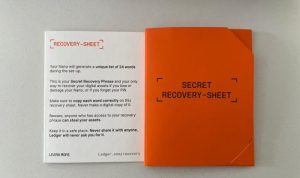

The Uphold Card comes equipped with robust security measures to ensure that cardholders’ financial information is well protected. This includes advanced encryption protocols and secure payment infrastructures to prevent unauthorized access.

One of the key security features is the multi-factor authentication process, which requires users to verify their identity through multiple steps before accessing their account. This adds an additional layer of protection against fraud and unauthorized transactions.

To further enhance personal security while using the Uphold Card, users are encouraged to follow these tips:

- Regularly update passwords and use strong combinations.

- Enable notifications for transactions to monitor account activity.

- Be cautious when using the card on public Wi-Fi networks.

Fees and Charges Associated with the Uphold Card

Understanding the fees associated with the Uphold Card is crucial for cardholders. Potential fees include transaction fees for purchases and withdrawals, which can vary depending on the asset type being used.

A comparison of the Uphold Card’s fee structure with other similar cards in the market reveals competitive pricing, making it an appealing option for those looking to manage multiple assets. Additionally, there may be promotional offers or waivers available for cardholders, particularly for new users or during specific promotional periods.

Customer Support and User Experience

Uphold provides multiple customer support options for users of the Uphold Card. These include a comprehensive help center, live chat, and email support to address any inquiries or issues that may arise.

User experiences with the Uphold Card have generally been positive, highlighting the card’s ease of use and integration with various asset classes. Testimonials from cardholders reflect satisfaction with the card’s functionality and convenience.

A comparison of user ratings and reviews across different platforms showcases the Uphold Card’s overall performance:

| Platform | User Rating | Review Count |

|---|---|---|

| Trustpilot | 4.5/5 | 500+ |

| Google Play Store | 4.4/5 | 1,000+ |

| App Store | 4.6/5 | 800+ |

Future Developments and Roadmap

Uphold is continuously innovating and has plans for several upcoming features and improvements for the Uphold Card. These may include enhanced integrations with popular e-commerce platforms and new asset types that users can spend.

Trends in the cryptocurrency and financial services space, such as increased regulatory clarity and the rise of decentralized finance, could significantly impact the Uphold Card’s evolution. Potential partnerships and integrations with other financial services and tech companies are also on the horizon, promising to enrich the card’s functionality further.