ZenLedger Crypto Tax Software: Simplifying Complex DeFi Transactions sets the stage for an essential discussion on how cryptocurrency users can navigate the intricate world of tax reporting with ease. As decentralized finance (DeFi) activities gain traction, the need for reliable tax software becomes paramount. ZenLedger not only streamlines the tax reporting process but also offers unique features that distinguish it from its competitors, ensuring that users can manage their crypto taxes with confidence and accuracy.

This software addresses the inherent complexities of DeFi transactions by providing automated solutions that integrate seamlessly with various cryptocurrency exchanges. By highlighting the significance of accurate tax reporting and the challenges faced by users, we can better appreciate the value that ZenLedger brings to the table.

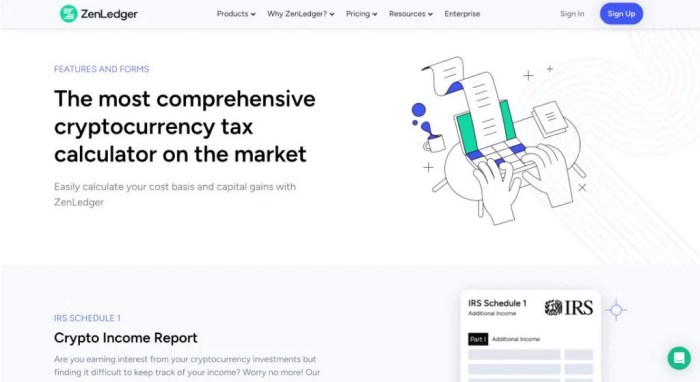

Overview of ZenLedger Crypto Tax Software

ZenLedger Crypto Tax Software is designed to simplify the often intricate process of tax reporting for cryptocurrency users. Its primary function is to automate the calculation of capital gains and losses resulting from crypto transactions, ensuring users maintain compliance with tax regulations. What sets ZenLedger apart from other crypto tax software is its comprehensive integration with various cryptocurrency exchanges and DeFi platforms, along with its user-friendly interface that caters to both novice and experienced investors. Accurate tax reporting is crucial for cryptocurrency users as it helps prevent potential audits and penalties, making ZenLedger an invaluable tool in the rapidly evolving digital asset landscape.

Purpose and Functionality

The main purpose of ZenLedger is to streamline the tax reporting process for cryptocurrency investors by providing automated solutions for tracking transactions across multiple exchanges. Key functionalities include:

- Importing transaction history from various exchanges and wallets seamlessly.

- Calculating capital gains and losses using different accounting methods, such as FIFO and LIFO.

- Generating IRS-compliant tax reports, including Form 8949.

- Providing insights into portfolio performance and tax impact.

Unique Features

ZenLedger distinguishes itself through several unique features, including:

- Integration with over 400 exchanges and wallets, ensuring comprehensive transaction tracking.

- A dedicated DeFi transaction support that accommodates the complexities of decentralized finance.

- Multi-currency support, enabling users to manage taxes across different digital assets effortlessly.

- A robust customer support system, including chat support and comprehensive tutorials.

Importance of Accurate Tax Reporting

Accurate tax reporting is vital for cryptocurrency users to avoid legal complications. Inaccurate reporting can lead to audits, fines, or even criminal charges in severe cases. ZenLedger helps mitigate these risks by providing tools that ensure accurate documentation of all transactions, thereby giving users peace of mind when it comes to their financial responsibilities.

Understanding DeFi Transactions: ZenLedger Crypto Tax Software: Simplifying Complex DeFi Transactions

Decentralized finance (DeFi) transactions involve a variety of complex financial activities that often blur the line between traditional finance and cryptocurrency. Understanding the nature of these transactions is essential for accurate tax reporting.

Complexities in DeFi Transactions

DeFi transactions can be significantly more complicated than standard cryptocurrency trades due to the following factors:

- Smart contracts involve intricate interactions that may not be easily traceable.

- Liquidity pools and yield farming introduce additional layers of transactions that can affect tax liabilities.

- Token swaps and staking can create multiple capital gain events within a single transaction.

Common Types of DeFi Activities

Several DeFi activities require tax reporting, including:

- Token swaps, which may trigger capital gains taxes.

- Liquidity provision in decentralized exchanges, generating fees taxable as income.

- Yield farming, where interest or rewards are received in the form of tokens, leading to potential taxable events.

Challenges in Documenting DeFi Transactions

Users face numerous challenges when documenting DeFi transactions, such as:

- Difficulty in tracking multiple transactions across various platforms.

- Understanding the tax implications of each DeFi activity can be overwhelming.

- Lack of standardization in reporting methods across different DeFi protocols.

How ZenLedger Simplifies Tax Reporting

ZenLedger is equipped with automated features that drastically simplify the tax reporting process for cryptocurrency users involved in DeFi.

Automated Features of ZenLedger

The software automates key aspects of tax reporting, including:

- Importing transaction data across multiple exchanges with just a few clicks.

- Real-time calculations of capital gains and losses as transactions occur.

- Automatic categorization of DeFi transactions, minimizing user input required.

Integration with Cryptocurrency Exchanges

ZenLedger integrates seamlessly with numerous exchanges, allowing users to connect their accounts for easy data synchronization. Key integrations include:

- Popular centralized exchanges like Coinbase and Binance.

- Decentralized platforms such as Uniswap and Aave.

- Wallet integrations that provide comprehensive transaction histories.

Categorizing DeFi Transactions

ZenLedger categorizes various DeFi transactions for tax purposes, ensuring users understand their tax obligations. Examples of categories include:

- Swaps categorized as capital gains or losses.

- Income generated from liquidity pools classified as ordinary income.

- Rewards from yield farming identified for potential taxation.

User Experience and Interface

ZenLedger offers a user-friendly interface designed to cater to users of all experience levels, making tax reporting a straightforward process.

User Interface Description

The ZenLedger interface is intuitive and easily navigable, featuring:

- A dashboard that summarizes all transactions and tax obligations at a glance.

- Clear instructions guiding users through the import and reporting process.

- Visual analytics tools that enhance understanding of portfolio performance.

User Feedback

User feedback regarding ZenLedger has been overwhelmingly positive, with many noting:

- The ease of use and straightforward reporting process.

- Effective customer support that assists with complex questions.

- The software’s ability to handle large volumes of transactions efficiently.

Onboarding Process Comparison

When compared to other crypto tax platforms, ZenLedger’s onboarding process is notably efficient, characterized by:

- Simple account creation and initial setup.

- Guided steps for importing transaction data.

- Immediate access to reporting tools once data is synced.

Pricing and Packages

ZenLedger offers a variety of pricing structures to accommodate different user needs, making it accessible for both casual investors and serious traders.

Pricing Structure Analysis

The pricing structure of ZenLedger includes several packages tailored to diverse user demands:

| Package | Price | Features |

|---|---|---|

| Starter | $49 | Up to 100 transactions, basic reporting |

| Pro | $149 | Up to 1,500 transactions, crypto support, additional reporting features |

| Premium | $299 | Unlimited transactions, priority support, and advanced analytics |

Details of Each Package

Each package offers unique features:

- The Starter package is ideal for beginners with minimal transactions.

- The Pro package includes features suited for active traders, such as enhanced reporting options.

- The Premium package provides comprehensive support for serious investors, including unlimited transaction tracking.

Free Trial and Money-Back Guarantee

ZenLedger provides users the option of a free trial, allowing potential customers to explore features before committing. Additionally, they offer a 30-day money-back guarantee, ensuring user satisfaction and confidence in the software.

Customer Support and Resources

ZenLedger prides itself on providing robust customer support and helpful resources for users.

Customer Support Options

The customer support options available include:

- 24/7 chat support for immediate assistance.

- Email support for more complex inquiries requiring detailed responses.

- Extensive FAQ section addressing common user concerns.

Available Resources

To assist new users, ZenLedger offers various resources:

- Tutorials covering setup, integration, and reporting processes.

- Guides on tax implications for different types of crypto transactions.

- Webinars and community discussions for in-depth understanding.

Community Forums and Help Centers, ZenLedger Crypto Tax Software: Simplifying Complex DeFi Transactions

ZenLedger also features community forums where users can share experiences and solutions, along with help centers for additional guidance on navigating the software.

Security and Compliance

Security and compliance are key priorities for ZenLedger, ensuring user data protection and adherence to tax regulations.

Security Measures

ZenLedger implements advanced security measures, including:

- Encryption of sensitive user data to prevent unauthorized access.

- Two-factor authentication for account security.

- Regular security audits to safeguard against vulnerabilities.

Compliance with Tax Regulations

ZenLedger helps users remain compliant with current tax regulations by:

- Providing tools that generate IRS-compliant tax reports.

- Staying updated on changing cryptocurrency tax laws.

- Offering guidance on how to report different types of crypto transactions accurately.

Mitigating Risks in Crypto Tax Software

While using crypto tax software poses some risks, ZenLedger mitigates them by:

- Ensuring data is stored securely and not shared without user consent.

- Regularly updating the software to address emerging threats.

- Providing clear documentation to help users understand their tax obligations.

Future Developments and Updates

Looking ahead, ZenLedger is committed to enhancing its platform to address the evolving needs of cryptocurrency users.

Announced Updates and Features

ZenLedger has announced several exciting updates, including:

- Enhanced support for emerging DeFi protocols and platforms.

- Advanced analytics tools that provide deeper insights into tax impacts.

- Integration with more exchanges and wallets to broaden transaction tracking.

Insights on the Evolving Crypto Landscape

As the cryptocurrency landscape evolves, ZenLedger aims to adapt its offerings by:

- Incorporating features that address new DeFi innovations.

- Regularly updating compliance measures in line with changing regulations.

- Expanding educational resources to keep users informed on tax implications.

Future Challenges in Crypto Tax Reporting

Future challenges in crypto tax reporting may include:

- Increased complexity of DeFi transactions requiring real-time reporting.

- Regulatory changes that could affect compliance requirements.

- The necessity for more sophisticated tools to address new financial instruments.